Many injury victims depend on attorneys for legal assistance when seeking financial compensation from those responsible. This actual damage compensation can cover expenses such as medical treatments and lost wages.

Law firm compensation models range from simple to complex formulas that account for metrics such as client origination credit and non-billable firm time; however, these models don’t always accurately represent lawyer experience.

Fees

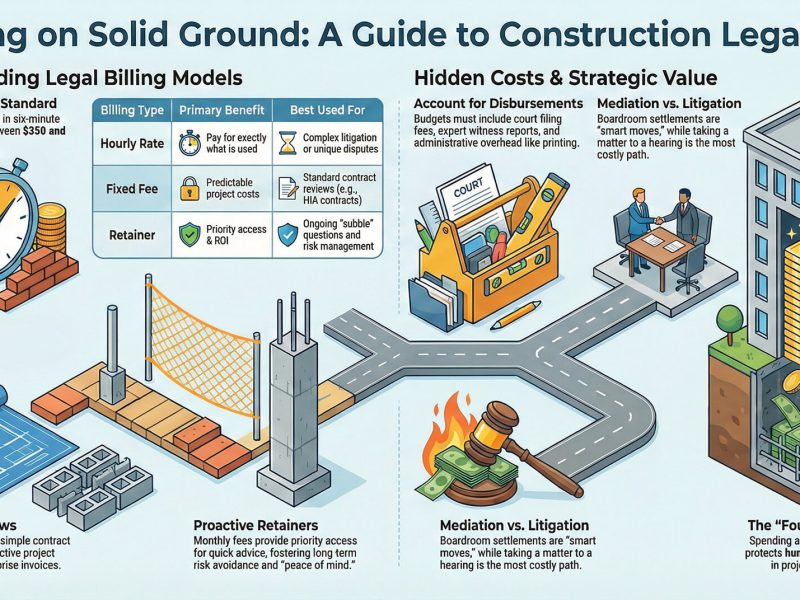

When hiring a lawyer, the type of fee arrangement you agree on with them can have a dramatic effect on your case. There are different forms of legal fees such as hourly rate fees, flat rate fees and contingency fees; each has its own set of advantages and disadvantages which should be tailored towards your unique circumstances and budget.

Workers’ comp cases are typically handled on a contingency fee basis, meaning the lawyer’s fee is calculated as a percentage of any award obtained in court. This payment structure reduces up-front expenses while encouraging attorneys to work hard on behalf of their clients.

Other lawyers charge a flat rate, which is a single, fixed amount that covers every aspect of their services from initial consultation through final payment. This fee arrangement tends to be preferred when handling simple or routine legal issues such as divorce proceedings or traffic ticket resolution.

Some attorneys may charge expenses such as travel, photocopying and hiring experts to testify in your case separately from their fee; any such additional expenses should be clearly listed within your original agreement with your lawyer.

Once your case has been resolved, your attorney will submit a fee request to the workers’ compensation board outlining all services rendered to you. The board will assess your request and decide whether it is reasonable, taking into account factors like its complexity, results achieved and time invested in filing it. In most cases, the board will approve of your requested fee request; if deemed unreasonable they may reject or reduce it. Before signing any fee agreement be sure to carefully read it and ask any questions that arise before making your decision. Attorneys should never pressure or force clients into signing their agreements without reviewing them fully first – any such behavior should serve as a red flag and you should consider seeking other attorneys instead.

Experience

There are various factors that can have an effect on attorney fees. One such factor is experience level – more experienced lawyers tend to be in higher demand and charge accordingly. Another consideration is case complexity; more complex matters will take more time, effort and legal skill in order to resolve them successfully.

There are various fee arrangements attorneys use. Some operate on a contingency fee basis, meaning they receive a percentage of whatever money is awarded to a plaintiff in their lawsuits; other attorneys charge hourly rates; additionally they may also add extra charges for administrative tasks like research.

Some attorneys work as salaried employees for large corporations or government agencies; patent/trademark attorneys for these clients usually receive benefits such as health insurance and retirement plan contributions.

Attorneys working as salaried employees may practice in either private practice or be employed by a law firm. Alongside their salary they may also receive a retainer payment that allows clients to reserve their lawyer for specific cases or projects; then funds are drawn down from this retainer as work progresses and any remaining amount credited back back to them at project’s end.

Some attorneys also work on retainer for specific law firms; this means they will be available for their client for an agreed upon monthly cost – referred to as earned retainers.

No matter their fee arrangement, all attorneys should be transparent with potential clients regarding fees and costs associated with working with an attorney. Doing so will help alleviate any anxieties about financial implications when hiring legal representation as well as enable informed decisions about whether their services fit within their budget or not.

Retainers

Retainers are an effective payment structure that benefits both attorney and client. A retainer ensures that a lawyer will be available during an agreed upon timeframe and pays them accordingly; while for clients it provides an estimated budget for legal expenses during that period. Furthermore, this agreement can foster greater trust between lawyer and client.

Retainer fees can either be paid in lump sum or hourly increments; regardless, attorneys should make it clear to clients what their fees will entail and how they will be charged. For instance, hourly-rate clients should receive monthly statements outlining attorney hours spent working on their matter as well as any costs such as court or research fees; additionally they should explain frequency billing frequency policies regarding storage of client files.

If a retainer is paid as one lump sum, an attorney will typically deposit it into an appropriate trust account and draw from this fund as necessary during case work. If funds run out before case completion occurs, then either another retainer payment or hourly billing will likely occur.

However, paying a retainer doesn’t guarantee success for an attorney in their case. For example, when hired to defend an employer against employee allegations of workplace abuse, any refund would not apply if their client wins their suit against them. It is advisable for attorneys in these instances to stipulate in their agreement that no refund would be issued should their client lose.

Legal representation may be expensive, but it is necessary for businesses to protect themselves from potential legal actions that could threaten them in terms of workers’ comp or discrimination cases. Lawyers are vitally important in protecting assets and reputation of companies.

Per diem

As its name implies, per diem refers to an amount that employees receive daily as reimbursement for work-related travel expenses like lodging and meals incurred while traveling for their employment. Per diem costs are set by the federal government and may differ depending on your location. Per diem can also refer to lawyers retained to cover an appearance or cover the absence of an associate; under these circumstances firms can retain such lawyers on an hourly fee basis provided their fee charged to clients is reasonable; alternatively their hourly rate (after mark-up) should compares favorably with what an associate would charge their firm would charge an associate would charge them in terms of hourly fee payments made against per diem payments made out by legal firms themselves.

Per diem lawyers should take great care in hiring one, to avoid any conflicts of interest with the client and secure their consent prior to hiring one. They must inform them that their fee will be divided with another firm and if so how much is being paid to co-counsel attorney(s).

New York disciplinary rules mandate that lawyers receive client permission before contracting with outside lawyers to appear on their behalf in court or perform substantive or strategic legal work requiring independent judgment without close oversight from their referring lawyer. However, law firms may hire per diem lawyers on an hourly basis to complete discrete tasks which are closely overseen by their referring attorney; for example attending scheduling conference calls or route calendar calls is just an example.

One solution would be to amend Rule 1.5(g), so as to waive consent requirements when hiring per diem lawyers for routine and non-substantive work. This change may give small firms equal opportunities in competing in the per diem market.