Home purchasing can be one of the largest purchases most people ever make, which is why hiring an experienced, trustworthy NYC real estate attorney with reasonable fees should be priority number one.

Most attorneys charge by transaction rather than by hour; typically this will include reviewing or drafting simple contracts as part of their services as well as offering general advice about them.

Real estate attorney fees

Home ownership can be one of the most costly purchases you will ever make, and hiring an attorney to oversee its closing can add thousands to the bill. A real estate attorney will review and draft contracts, draft deeds and verify settlement funds at closing; in addition to managing bank fees and closing costs. Although not required in your state, consulting one will help avoid costly mistakes as real estate attorneys are experts at negotiating better deals on behalf of their clients and can guide through complex legal issues with ease.

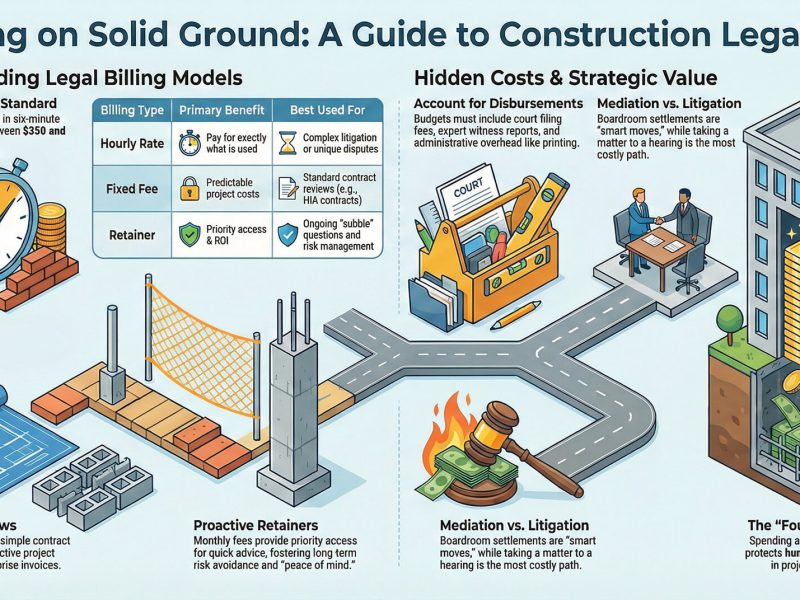

Some lawyers charge hourly, while others work on a fixed or flat fee basis. Your cost will depend on the nature and complexity of the case you need help with; while a simple landlord-tenant dispute might only cost $2,500 while more complex commercial real estate cases could run into thousands. Furthermore, how long a lawyer spends working on it will also impact its total cost.

If you are purchasing property in NYC, expect attorney fees to be more costly than in other states due to more stringent regulatory requirements and because new condo developments in New York often require buyers to cover developer attorney fees that could even double closing costs in certain instances.

Real estate attorney fees can be paid either as an upfront payment or in installments, typically half up front and half at closing. Furthermore, they may require an initial deposit payment as part of their fee structure.

Though many individuals might believe it to be cheaper to go without legal representation, this may not always be the best decision. Understanding the process and all associated legal documents can be very complex; additionally, an attorney may help identify any loopholes or misinterpretations in contracts that could cost money down the line and also ensure all paperwork is filed correctly.

Escrow fees

Escrow fees are part of the closing costs associated with buying a new home. They’re paid to a title company, escrow agent or real estate attorney who oversees and distributes funds to third parties involved in the sale – often including earnest money deposits as well as paperwork fees related to it. These costs typically include both base fees plus percentage of sales price plus distribution of earnest money deposits to cover earnest money distribution plus paperwork fees related to real estate sales transactions.

As part of the home buying process, both buyer and seller must negotiate who will cover escrow fees. These fees are often determined by market conditions – seller vs buyer market etc – although usually negotiated between parties prior to any offer being submitted for approval. Buyers also incur real estate attorney fees, recording fees and property taxes which can add up significantly; all this costs adds up over time!

Escrow plays an essential part in homebuying, ensuring all documents are signed and recorded correctly and that title passes to the purchaser in an uncomplicated way. Furthermore, this process serves to protect mortgage lenders in case there are ownership issues with a property; typically this entails various inspections including pest and electrical analyses as well as an appraisal to establish property value.

On average, escrow fees typically cost one to two percent of a home’s sales price and must be paid to either a title company or an escrow agent; these amounts may differ depending on which state you are in; they could even be higher than anticipated in certain instances.

Homeowners must also cover HOA fees and closing costs in addition to escrow fees when closing the sale of their property. Closing costs typically include real estate attorney fees billed hourly or flat fees as well as property tax and transfer fees that are assessed by local governments. Sometimes buyers offer to cover escrow fees in exchange for buying, but this could cause tensions with both parties and could signal lowball offers from potential sellers.

Mortgage broker fees

Home buying can be one of the biggest financial transactions you ever undertake, and closing costs can quickly mount up. Although mortgage brokers, lenders, and real estate agents usually explain mortgage fees before closing, many borrowers still find themselves surprised at what their final costs turn out to be; mortgage fees can often be confusing and contain hidden “junk fees” that don’t provide value for borrowers.

Mortgage broker fees and attorney fees are among the most frequently charged “junk fees.” Mortgage broker fees are charged by mortgage brokers when collecting required documentation on behalf of borrowers such as income verification, credit reports and property appraisals; typically the fee ranges between 1%-2% of loan amount (typically paid either upfront at closing or rolled into loan amount) but may also charge a flat fee to close deals.

The mortgage industry is heavily regulated and monitored by federal agencies, and mortgage brokers must adhere to specific guidelines when disclosing to borrowers. Ernst Fee Service from Black Knight helps mortgage brokers comply with regulations by accurately communicating fees to borrowers while also seamlessly integrating into core lending systems to deliver Loan Estimates and Closing Disclosures more quickly and accurately.

Mortgage fees may seem complicated, but they’re actually much less of a burden than you might imagine. For instance, when purchasing a co-op apartment in New York City you will incur various broker and transfer taxes fees, recording costs, as well as recording recording fees that could add up to thousands of dollars in fees.

Mortgage fees can include attorney and title insurance costs; however, these may not always be necessary when purchasing a condo or co-op. Mortgage fees don’t vary depending on where you shop for loans so be sure to shop around and compare rates as much as possible before selecting your lender(s). Furthermore, ask your broker how many lenders they work with as well as any preferred ones before selecting your lender(s).

Closing costs

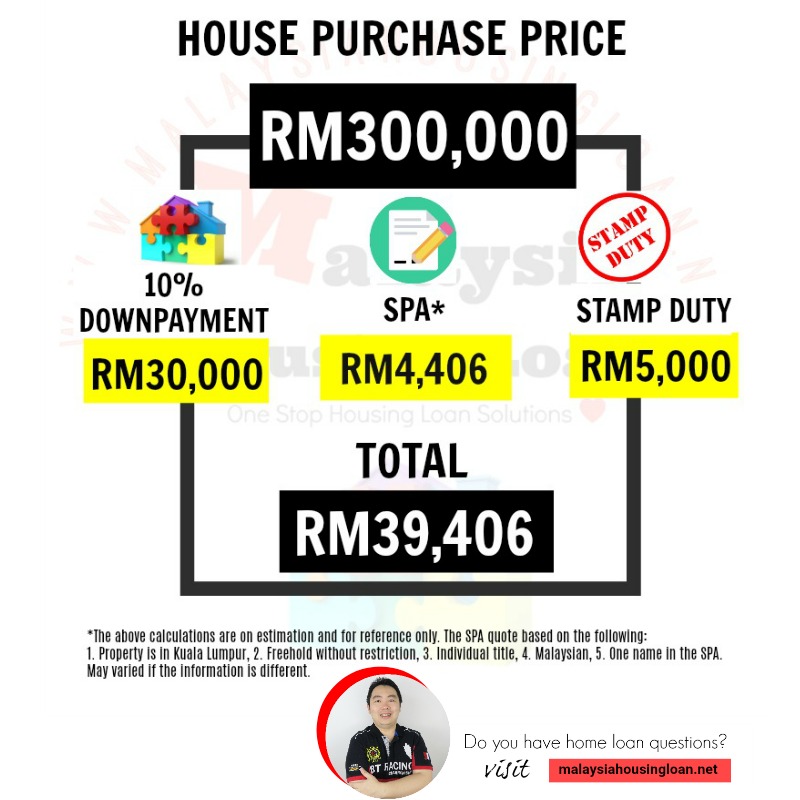

Real estate transactions involve several legal and administrative costs that must be collected at closing, usually between 2-5 percent of the purchase price of the home. Closing costs cover services provided by third parties such as lenders or real estate attorneys – they should give an idea of the likely closing costs when you receive a Loan Estimate from them.

Attorney fees are an integral component of real estate closing costs and will depend on the complexity and market of each transaction. Some attorneys charge an hourly rate; this can become prohibitively expensive when your transaction requires extensive work; others work on a flat rate which may be more affordable; other times they charge per communication (even if just to discuss a minor matter), so make sure your negotiations go smoothly! Additionally, be wary when paying bills from them- they could bill for every time they speak to you even for minor matters!

Closing costs often include legal and escrow company fees as well as additional charges related to the transaction itself, such as credit reports, title insurance premiums and deposits in an escrow account. There may also be transfer taxes, surveys fees or courier fees related to transporting papers – costs which typically total well over $10,000 in an average residential sale transaction.

In New York, it’s generally expected for sellers to pay their share of real estate taxes and attorney fees at closing; however, these expenses may be negotiable between buyer and seller; in an active real estate market, buyers may negotiate to cover some or all of these expenses themselves.