Real estate attorneys play an invaluable role in home sales transactions. They review contracts, help negotiate terms, oversee closings and ensure compliance with national and state legal requirements.

However, their costs vary considerably depending on factors like attorney selection, deal complexity and location.

Costs

When purchasing a home, there are numerous expenses you should keep in mind when planning. Aside from sale price and down payment costs, additional legal costs associated with closing can quickly mount up; so it’s essential that you remain aware of these additional expenses so as to budget properly.

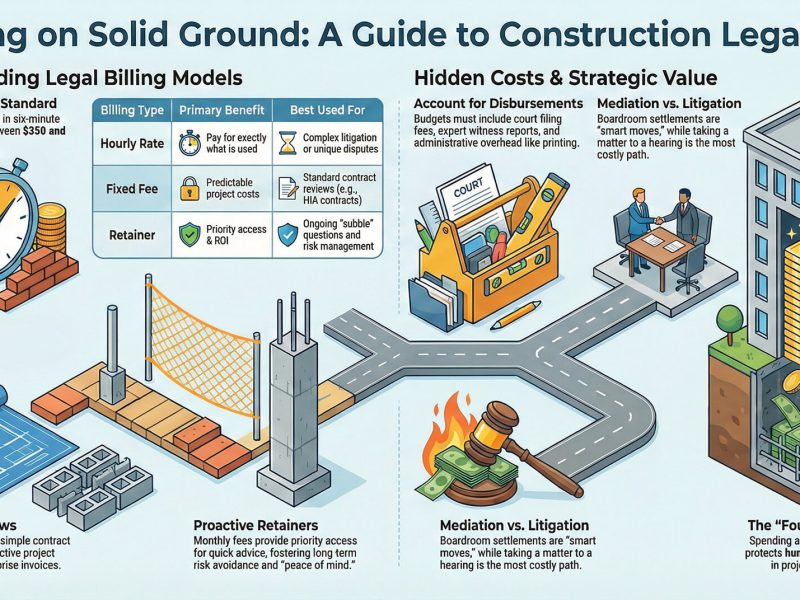

Cost of real estate attorneys varies based on experience and location; some charge a flat fee while others bill per hour; additionally, there may be charges associated with communicating via phone or email; if purchasing property in an area where multiple lawyers exist, competition could drive prices down further.

Title searches, lender’s title insurance and notary fees are three of the most frequently paid fees. Title searches often involve reviewing public records to check for outstanding liens against a property and can run between $75 to $200; lender’s title insurance protects mortgage lenders in case there are issues with title ownership; this typically costs an additional $500-1,000.

Notary fees cover the expense of having your mortgage paperwork notarized and signed by a notary public; typically this cost ranges from $30-$50. Additional costs that you might encounter include transfer taxes imposed by government on ownership transfers as well as document recording fees which vary based on jurisdiction.

Real estate attorneys provide invaluable assistance throughout the real estate transaction, from contract negotiating and reviewing to understanding mortgage requirements and any other requirements before closing. They can even guide negotiations during negotiations as they advocate on your behalf to make sure you get what you pay for. Though their initial investment may seem substantial, real estate attorneys offer peace of mind by crossing every t and dotting every i in your contract before signing – opting out could cost more in the end due to complications during closing process or something going amiss during settlement process.

Time

Purchase of a house can be a complex and time-consuming process, with numerous fees that may add up over time – including mortgage lender’s fee, attorney’s fee and title service fee as well as miscellaneous charges that could quickly strain a buyer’s budget. Therefore, it is vitally important that prospective homebuyers plan for these expenses from the very start of the purchase process.

Home purchases involve multiple costs that must be considered when planning for their purchase and down payment, including inspection and appraisal fees that should also be taken into account when budgeting for a home purchase. The two most prominent costs are purchase price and down payment. Other expenses, however, such as inspection and appraisal costs should also be factored into planning budgets to accurately reflect costs involved with buying real estate.

Real estate attorneys typically charge a flat fee or hourly rates depending on the complexity and region of purchase. On average, NYC real estate attorneys charge around $2000 for standard closing.

Attorneys typically perform several tasks prior to closing, such as conducting a title search and reviewing seller disclosures. They may also assist in securing loan commitments and creating closing statements, and communicate with lenders or third-party entities involved such as co-op boards as necessary.

Prior to signing your sale contract, it’s essential that a real estate attorney review it thoroughly. A good attorney will be able to spot language that unfairly benefits the seller or could potentially cause future issues for you; plus they may help negotiate better deals for you.

Closing on real estate typically takes between 60-90 days; due to NYC’s slower real estate market, closing times can sometimes extend further than that. At closing time, your attorney will attend and ensure all documents are completed according to contract. In addition, they can assist with calculating closing costs which could amount to thousands.

Experience

Purchase of a home can be one of the largest financial commitments anyone makes, so it is vitally important that all fees associated with homeownership are taken into consideration before making your commitment. Otherwise, it could become apparent that you aren’t as financially prepared to become a homeowner as first anticipated. Here are some costs associated with buying a house:

Legal Fees: Attorneys typically charge an hourly rate ranging from $150 to $350 an hour for their services and must also charge to prepare real estate closing documents and courier fees when transporting mortgage documents – expenses which can quickly add up if left unplanned for.

Appraisal Fee: An appraisal fee refers to the cost associated with hiring a professional appraiser to inspect your property and prepare a report. A professional will look at it from all sides and identify any potential issues – for example if there is asbestos or lead pipes within it – this information will allow you to make the right decisions for moving forward with purchasing it or not.

Title insurance: Title insurance is an essential component of closing, protecting your investment from unanticipated circumstances. Before signing a final contract, be aware of how much this policy costs; its cost depends on the value of your property.

Home inspection: While not mandatory, home inspection is highly recommended for buyers as it allows you to better assess the condition of a new property and negotiate better terms from its seller. Furthermore, peace of mind knowing that it’s safe will give buyers comfort during negotiations.

Transfer taxes: Transfer taxes must be paid when purchasing property, with fees typically being assessed between 1%-1.2% of its sale price depending on your location.

Realtor’s Commission: Your real estate agent typically receives a commission of 6% of the selling price when selling a property for you.

When buying co-ops or condos in NYC, it is wise to engage the services of a real estate lawyer. Fees usually range between $2000-3000 for “normal” transactions – however prices could increase if involved luxury properties or more complex transactions.

Location

Real estate attorneys typically charge by the hour, with fees usually being higher in metropolitan areas than rural regions.

Average costs associated with hiring a real estate attorney for residential transactions typically fall in the range of $500-1,500, typically covering contract review or drafting, general advice, and closing documents review or preparation. However, in-house closings or more complex transactions may incur higher attorney fees.

Not only will you need to pay your lawyer’s fee, but there may be additional legal expenses such as transfer tax or title search costs as well. While these can add up quickly and make the purchase more expensive, these costs can often be split among seller and buyer and shared accordingly.

Before purchasing property, it is essential that you hire a home inspector to conduct an inspection. A home inspection can reveal any potential issues such as infestations or old lead pipes that need addressing; furthermore, an inspection gives an idea of its condition and market value, helping you decide whether or not to buy the property.