Lawyers typically charge a contingency fee, usually 33% to 40% of any final settlement or court award, which can be negotiated and clearly stipulated in an attorney’s fee arrangement agreement. Additional costs such as court filing fees or medical record retrieval costs may also incur, making their services costly.

Contingency fees

In New York, contingency fees typically comprise one-third of any settlement or award reached between client and attorney. This allows clients to access legal representation without incurring upfront costs while giving attorneys an vested interest in securing favorable outcomes in each case.

However, it is essential to realize that attorneys must also cover any expenses or fees associated with handling a case, such as court filing fees, expert witness fees and general investigation expenses. All such expenses will be deducted from a client’s share of settlement before calculating a contingency fee.

Ideal, attorneys should clearly communicate these expenses and fees with their clients up-front to prevent confusion or disagreements later on. Furthermore, it’s best for attorneys not to charge more in contingency fees than what is permissible under law; ultimately this ensures clients receive maximum compensation while simultaneously discouraging unethical behavior among attorneys.

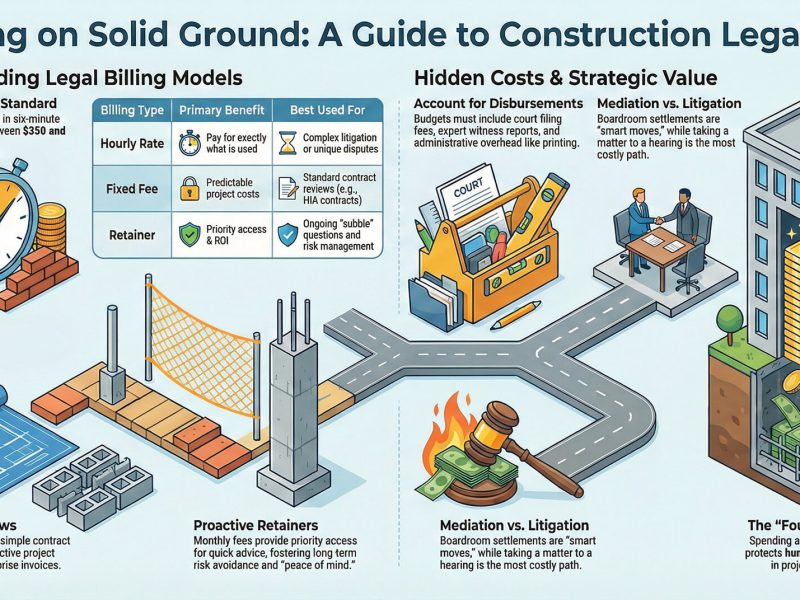

Hourly rates

Most lawyers charge hourly rates, flat fees or contingency fees for their services. The exact fee structure depends on various factors including experience and location; those with strong track records will often charge premium rates.

Hourly fees are calculated in six-minute increments to make calculations both practical and ethically responsible. Six-minute increments make billing easier to track while helping prevent excessive “bill padding,” leading to overbilling. Legal billing software automates this process to save time and reduce human error.

An attorney’s fee depends on their level of expertise and experience in handling cases, their rates, as well as any deductions (for example medical liens or court costs) from your settlement amount.

Retainers

Each legal case presents a unique challenge that demands thorough research and analysis by attorneys. Lawyers must study precedents while simultaneously understanding individual client needs in order to produce optimal results for them. As this type of work can often require teams of legal specialists, it is vital for lawyers to be transparent with regards to fees and arrangements so as to prevent misunderstandings among their clients and ensure they understand how fees are charged.

Retainer fees are upfront payments that cover a set amount of an attorney’s hourly rate and are held in trust until used up; once done so, these funds will be returned back to their clients. Some retainers are non-refundable – in this case buying their time slot in their schedule cannot be returned if not necessary; these arrangements tend to be used when undertaking large legal projects with significant planning and negotiation required.

Deposits

Deposits are one of the many fees accepted by lawyers to cover costs and expenses, similar to advances and flat fees, with both types available either as refundable or nonrefundable options. Before hiring an attorney, it’s wise to inquire as to their experience, reputation and fee arrangement policies before making your choice.

When accepting deposits or advances on fees from clients, lawyers must place them into an escrow or “trust” account in the client’s name – this account should remain separate from their operating accounts and should be clearly labeled accordingly.

These funds cover expenses such as medical records, depositions, and expert witnesses; eventually they’re deducted from the final settlement amount as necessary legal costs are deducted; often leading to larger settlements for clients – say for instance if an initial $100,000 settlement had included all legal costs and expenses it might have decreased by half to $60,000 after deducting these costs and expenses from your final total.